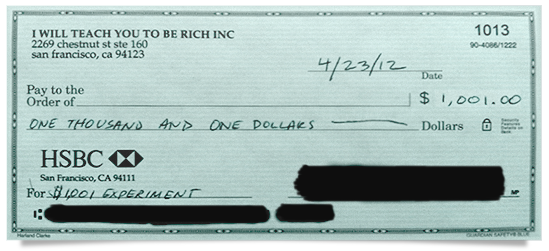

ONE THOUSAND DOLLAR CHECK HOW TO

Let’s see the example, how to write a 1000 dollars amount on this line.įinally, draw a line in the blank section. Cents, however, should be written in fraction form. Step 4: Word Line: The dollar amount should also be written in expanded word form on the blank line below the recipient’s name. Step 3: Number Box or Dollar Box: Enter the dollar and cents amount using the number. Step 2: Pay Line: In this line, write the name of the person or company you are paying the check. Step 1: Date Line: At the top right corner of the check on the blank space. Example of how to fill a check for 1000 dollars. Read on to learn how to fill out a check for 1000 dollars. We think that after you read this post, you will understand “how to write a check for 1000 dollars” or what you need to write a 1000 dollars check. Everything you need to know about writing a 1000 dollars check or what you need to write is discussed in detail below (with pictures). Welcome to how to write a check for 1000 dollars. If you ever lose your checkbook, it’s a good idea to contact your bank or credit union immediately so they can help you protect your account.If you are searching for how to write a check for 1000 dollars through your search engine. Keep your checkbook safeĪ lost checkbook can lead to problems, including check fraud, so it’s important to keep your checkbook in a safe place and protect it like you would a debit or credit card. You can then compare the paper copy to your online balance and ensure there are no discrepancies.

ONE THOUSAND DOLLAR CHECK UPDATE

Every time you write a check, update your checkbook register. A checkbook register is a way to stay up to date on your account balance. Most checkbooks come with a checkbook register-also called a balance book. While there are digital tools available to help with balancing your checkbook online, it’s not a bad idea to keep a paper copy as well. You can avoid bouncing a check or overdrawing your account by keeping tabs on your checking account balance. Now that you know how to write a check, here are a few tips to consider following: Know your checking account balance Without it, your check generally can’t be cashed or deposited. Your signature is one of the most important parts of a check. Lastly, you’ll sign the check on the line in the bottom right corner. If the check is for a specific month’s rent or a particular service you’ve received, you can list that in the memo field. Include a memoįilling in a check’s memo line may not be required, but it can be helpful to write what the check is for. That will help ensure the entire field is full, which can help prevent someone from changing the amount of your check. Then draw a line through any remaining space to the right of the amount listed. When writing out the dollar amount in words, write the amount as far to the left as you can. For example, if you’re writing a check for $1,500, write out “one thousand, five hundred and 00/100.” So if the check amount is $44.99, write “forty-four and 99/100.” Even if the dollar amount has no cents, it’s typically best to include a “00/100” for clarity. To include the cents, use a fraction with “100” on the bottom. For example, if the amount of the check is $1,000, write “one thousand.” This larger field often ends with the word “dollars,” and the amount should be spelled out in words in this location. The second location for the dollar amount is directly below the recipient’s name. Don’t forget to add the comma and the decimal point.įor the amount box, write in numbers large enough to fill the entire space to help prevent fraud. Use a decimal point in the small box-for example, if your check amount is $100, write 100.00.It usually begins with a dollar sign, so you don’t need to write one in. It typically is a small box for numerals only. The first location for the payment amount is to the right of the recipient’s name. There are two places where you need to list the dollar amount of your check in both dollars and cents. Spelling the name of the person or business wrong or leaving off part of a payee’s name could result in your check being returned.

ONE THOUSAND DOLLAR CHECK FULL

Make sure this field is filled out correctly with the recipient’s full name. The field for the recipient’s name usually begins with “Pay to the order of.” The recipient, also known as the payee, is the business or person to whom you’re writing a check. And that can result in a bounced check or overdraft. It’s typically not allowed, and it may even be illegal in some situations.Ī postdated check, which has a future date, might be legal in some instances, but it could be deposited before the date listed on the check. Backdating a check occurs when a previous date is listed. Make sure your check reflects the current date-and write it in the top right corner.

0 kommentar(er)

0 kommentar(er)