The available payment options will vary depending on the amount of the transfer. Western Union allows you to pay for your transfer in three ways: with credit/debit cards, using your bank account, or paying cash in-store. You'll also be charged other transfer fees depending on your payment method and how the recipient will receive their money.

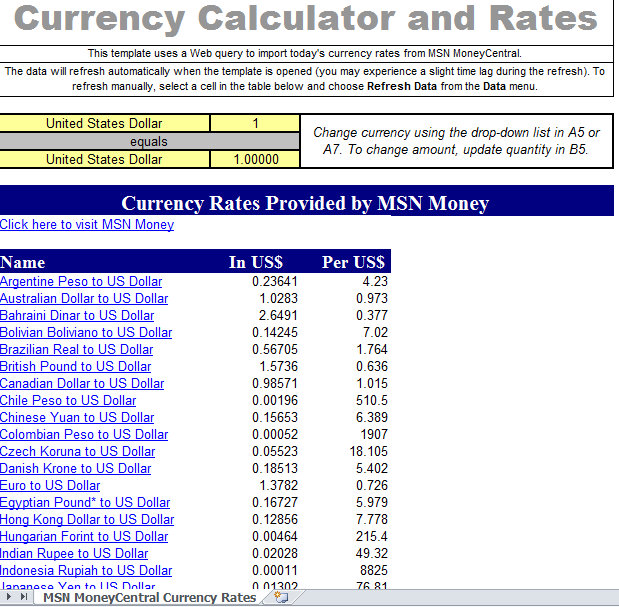

This is the exchange rate that Western Union is offering to you.

When creating your transfer, you will be given a guaranteed rate. Since they will receive money in their local currency, the money that you send will be converted. You can also send the money to their bank account. When sending money using Western Union, your receiver will get cash in their local currency that they can pick up from Western Union agent locations. You also do not need to open a bank account to exchange currencies. However, they have many locations where you can receive payments in cash. Western Union mainly acts as an intermediary and they do not perform the functions of a conventional bank. Western Union’s exchange rates are usually better than the banks, but there may be fees that can make certain transfers more expensive. They are not a bank, but their foreign exchange services are similar to the ones offered by the major banks. Western Union is a financial services company that specializes in letting users transfer money internationally. This includes foreign exchange companies, online currency exchanges, and forex brokers. Instead, the mid-market rate is generally used as a benchmark.īesides the major banks, there are other ways to exchange currencies in Canada. You will be paying the forex spread when you buy and sell foreign currencies, and you will not be able to buy or sell at the mid-market rate. This means that the forex spread is the amount of money that your bank or broker would make. The mid-market rate is the price in-between the bid (buy) price and the ask (sell) price. The ask price is the rate at which your broker or bank is willing to sell currency, while the bid price is the rate at which they are willing to buy it from you. The foreign exchange spread, also known as a bid-ask spread, is the difference between buying and selling foreign currency using CAD.

This is known as a foreign exchange spread. That’s because you will be buying at a slightly higher price and selling at a slightly lower price. Instead, a percentage of the transaction is taken out each time you exchange currencies. The Foreign Exchange Spread: If you exchange CAD for USD and then convert it back to CAD, you will not have the same amount that you started with. The foreign exchange (forex) rate that you see from your bank is influenced by the forex exchange spread and the type of transaction that the currency conversion is for. Some banks may also charge additional fees to non-clients purchasing foreign currency. This means having a bank account or credit card with them. Some banks require you to be a client in order to use the bank’s currency exchange services. However, banks are reliable, accessible, and easy to use. The opposite is also true if you are buying Canadian Dollars with a bank. This means that if you are buying a foreign currency, you will be paying more Canadian Dollars to receive less foreign currency. Banks will typically have a worse exchange rate compared to the actual market rate. One way that you can convert Canadian Dollars (CAD) into a foreign currency is by using a bank. The “Big 5” are Canada’s 5 largest commercial banks: RBC, TD, Scotiabank, CIBC, and BMO.

0 kommentar(er)

0 kommentar(er)